Altcoin Liquidity Pools: Identify High-Yield Opportunities

Altcoin liquidity pools offer opportunities for investors to earn rewards by providing liquidity to decentralized exchanges; identifying high-yield opportunities requires evaluating factors like trading volume, pool size, impermanent loss risk, and platform reputation.

Are you looking to dive into the world of decentralized finance (DeFi) and potentially earn passive income? Understanding and leveraging altcoin liquidity pools: how to identify and profit from high-yield opportunities can be a game-changer. This guide will provide you with the knowledge and tools necessary to navigate this exciting space.

Understanding Altcoin Liquidity Pools

Altcoin liquidity pools are a fundamental component of decentralized exchanges (DEXs). They enable trading of cryptocurrencies without the need for traditional market makers. Here, we will explore the basic concepts and mechanics of these pools.

What is a Liquidity Pool?

A liquidity pool is essentially a collection of cryptocurrencies locked in a smart contract. This pool provides the liquidity needed for traders to buy and sell these assets on a DEX.

How Liquidity Pools Work

Liquidity providers (LPs) deposit tokens into the pool, receiving LP tokens in return. These LP tokens represent their share of the pool. Traders can then swap tokens within the pool, paying a small fee that is distributed to the LPs proportionally to their share.

- Liquidity providers earn fees from trades.

- Pools eliminate the need for order books.

- Automated market makers (AMMs) determine prices.

In essence, liquidity pools create a decentralized and permissionless way to trade cryptocurrencies. By understanding the basics, you can start exploring the opportunities they offer.

Benefits of Participating in Altcoin Liquidity Pools

Participating in altcoin liquidity pools can offer several benefits, but it’s important to understand both the potential rewards and risks involved. Let’s delve into the specific advantages.

Earning Passive Income

One of the primary benefits is the potential to earn passive income through trading fees. As traders use the pool, LPs receive a portion of the fees generated, proportional to their share of the pool.

Access to Emerging Altcoins

Liquidity pools often provide access to newer or less established altcoins that may not be listed on major centralized exchanges. This can present opportunities to invest in promising projects early on.

- Potential for high returns through trading fees.

- Exposure to new and innovative altcoins.

- Contribution to the DeFi ecosystem.

However, it’s crucial to remember that participating in liquidity pools is not without risk. Impermanent loss, which we’ll discuss later, is a significant factor to consider.

Risks Associated with Altcoin Liquidity Pools

While providing liquidity to altcoin pools can be lucrative, it is crucial to understand the associated risks. Here, we will dissect the key dangers involved.

Impermanent Loss

Impermanent loss occurs when the price ratio of the deposited tokens changes compared to when they were deposited. This can result in LPs having less dollar value than if they had simply held the tokens.

Smart Contract Risks

Liquidity pools are governed by smart contracts, which are susceptible to bugs or exploits. A flaw in the smart contract could lead to a loss of funds.

Understanding these risks is paramount before diving into liquidity pools.

Rug Pulls

Rug pulls are unfortunately common in the DeFi space, especially with newer altcoins. This involves the project team draining the liquidity pool and disappearing, leaving investors with worthless tokens.

- Potential for significant financial losses.

- Need to thoroughly vet projects and smart contracts.

- Importance of diversifying across multiple pools.

Addressing these risks through careful research and risk management is essential for safely participating in altcoin liquidity pools.

Identifying High-Yield Altcoin Liquidity Pools

Identifying high-yield altcoin liquidity pools requires a strategic approach and careful analysis. Let’s explore some key factors to consider when seeking profitable opportunities.

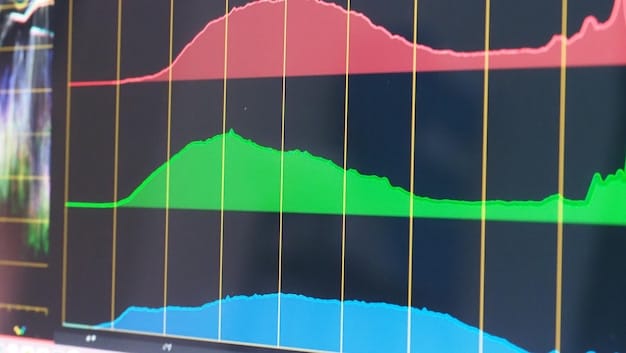

Analyzing Trading Volume

Trading volume is a crucial indicator of a pool’s profitability. Higher trading volume generally translates to more fees for liquidity providers.

Evaluating Pool Size

Pool size, or total value locked (TVL), can also impact returns. A smaller pool may offer higher percentage yields, but it can also be more susceptible to impermanent loss and price volatility.

Assessing Impermanent Loss Risk

Consider the potential for impermanent loss based on the volatility of the underlying tokens. Stablecoin pairs generally have lower impermanent loss risk compared to volatile altcoins.

Choosing the right pools is crucial for maximizing returns and minimizing risk.

- Focus on pools with sustained trading activity.

- Analyze TVL in comparison to trading volume.

- Monitor impermanent loss tracking tools.

By carefully analyzing these factors, you can increase your chances of identifying high-yield altcoin liquidity pools.

Tools and Resources for Finding Profitable Pools

Several tools and resources can help you in your search for profitable altcoin liquidity pools. Here, we’ll explore some of the most useful options.

DeFi Analytics Platforms

Platforms like DeFi Pulse, DappRadar, and CoinGecko provide comprehensive data on various DeFi projects and liquidity pools.

Impermanent Loss Calculators

Tools like impermanent loss calculators can help you estimate the potential impact of price fluctuations on your pool holdings.

These resources are essential for staying informed and making data-driven decisions.

- Regularly monitor key DeFi dashboards.

- Use analytics platforms to compare pool performance.

- Utilize impermanent loss calculators to assess risks.

By effectively using these tools and resources, you can gain a competitive edge in the altcoin liquidity pool market.

Strategies for Minimizing Risk and Maximizing Returns

Successfully navigating altcoin liquidity pools involves implementing strategies to minimize risk and maximize returns. Let’s discuss some effective techniques.

Diversifying Across Multiple Pools

Diversification is key to mitigating risk. By spreading your liquidity across multiple pools, you reduce your exposure to any single project or asset.

Monitoring Pool Performance

Regularly monitor the performance of your pools, paying attention to trading volume, fees earned, and impermanent loss. Adjust your strategy as needed.

Staying proactive and informed is crucial for achieving long-term success.

- Diversify across different blockchain networks.

- Track performance metrics daily.

- Rebalance your portfolio periodically.

By implementing these strategies, you can improve your chances of achieving sustainable returns in altcoin liquidity pools.

| Key Point | Brief Description |

|---|---|

| 💰 Earning Potential | Liquidity pools offer a way to earn passive income through trading fees. |

| ⚠️ Impermanent Loss | Price changes of deposited tokens can lead to less dollar value than holding. |

| 🔎 Pool Analysis | Analyze trading volume, pool size, and impermanent loss risk to identify high-yield pools. |

| 🛡️ Risk Mitigation | Diversify across multiple pools and monitor performance regularly to minimize risk. |

Frequently Asked Questions

▼

Joining altcoin liquidity pools allows you to earn passive income through trading fees, gain exposure to emerging altcoins, and contribute to the decentralized finance ecosystem.

▼

The primary risks include impermanent loss, smart contract vulnerabilities, and the potential for rug pulls, especially with newer altcoins. Mitigating these risks is crucial for successful participation.

▼

Assess profitability by analyzing trading volume, evaluating pool size (TVL), assessing impermanent loss risk, and carefully researching the reputation of the underlying project and platform.

▼

DeFi analytics platforms like DeFi Pulse, CoinGecko, and DappRadar, as well as impermanent loss calculators, can provide valuable data and insights to guide your decision-making process.

▼

Strategies include diversifying across multiple pools, closely monitoring pool performance (trading volume, fees, impermanent loss), and regularly rebalancing your portfolio to mitigate your exposure to any single asset.

Conclusion

Altcoin liquidity pools present both exciting opportunities and potential risks. By understanding the fundamentals, carefully evaluating pools, and implementing effective risk management strategies, you can increase your chances of profiting from this dynamic sector of the DeFi landscape.