DePIN Projects: Maximize Returns Before EOY 2025

DePIN projects present a crucial, time-sensitive investment opportunity to maximize returns before the end of 2025, by decentralizing physical infrastructure and disrupting traditional industries.

The digital landscape is constantly evolving, and a significant, time-sensitive opportunity: maximizing your returns with emerging DePIN projects before the end of 2025, is now on the horizon. This period offers a unique window for investors and enthusiasts to engage with a transformative sector that promises to redefine how physical infrastructure operates.

understanding decentralized physical infrastructure networks (DePIN)

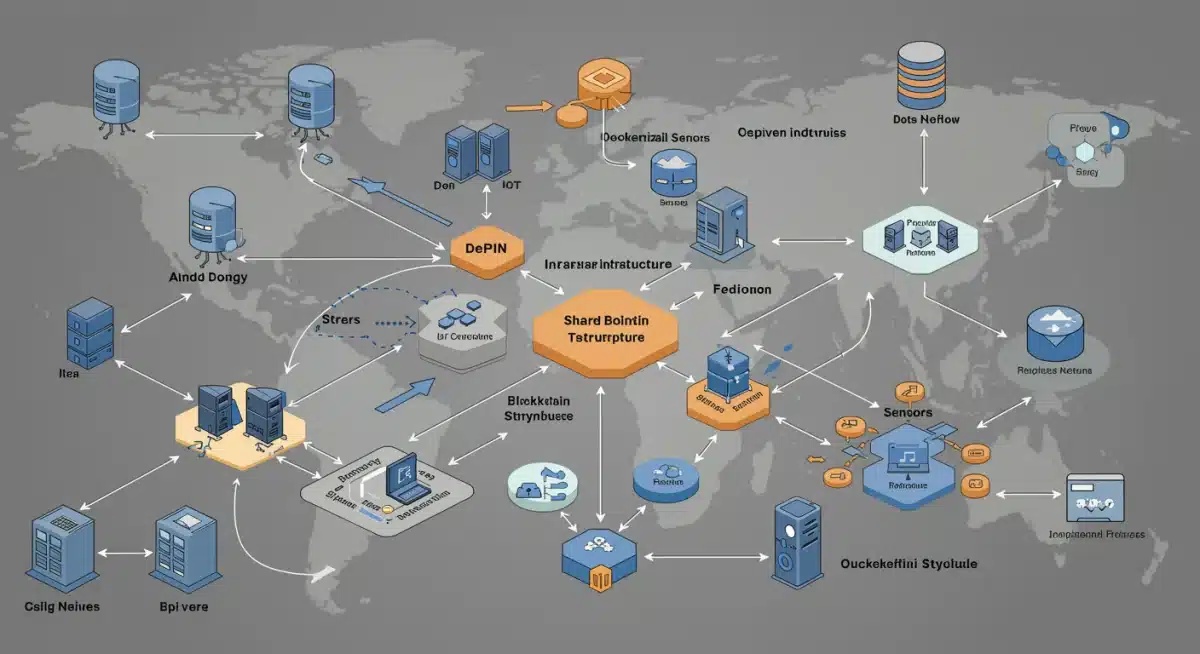

Decentralized Physical Infrastructure Networks, or DePINs, represent a groundbreaking paradigm shift in how we build, operate, and maintain essential services. At its core, DePIN leverages blockchain technology to incentivize individuals and organizations to contribute to the creation and maintenance of real-world physical infrastructure. This ranges from wireless networks and energy grids to sensor arrays and storage solutions, all powered by a distributed, open, and permissionless framework.

Unlike traditional centralized models, where large corporations or governments own and control infrastructure, DePINs distribute ownership and operational responsibilities among a community of participants. This decentralization fosters greater resilience, transparency, and efficiency, while also creating new economic opportunities for contributors. The underlying blockchain ensures secure, immutable record-keeping and fair distribution of rewards.

the core principles of DePIN

Understanding the foundational principles of DePIN is crucial for appreciating its potential impact and identifying promising projects. These principles guide the development and operation of successful decentralized networks.

- Decentralization: Power and control are distributed, eliminating single points of failure and reducing censorship risks.

- Token Incentives: Participants are rewarded with native tokens for contributing resources, ensuring network growth and sustainability.

- Physical Infrastructure: Focuses on real-world assets and services, bridging the gap between digital and physical realms.

- Community Governance: Network decisions are often made by the community, promoting transparency and user ownership.

In essence, DePIN projects are not just about technology; they are about reimagining the economic models behind infrastructure development. They empower a global network of individuals to participate in building the next generation of essential services, creating a more robust and equitable system. The ability to earn tokens for providing a service or resource is a powerful driver for widespread adoption and growth.

The movement towards DePIN is driven by the desire for more resilient and accessible infrastructure. Centralized systems often face challenges related to high operational costs, lack of transparency, and vulnerability to attacks or failures. DePINs offer a compelling alternative by distributing these risks and rewards across a broader base of participants, fostering innovation and reducing reliance on single entities. This fundamental shift is what makes DePIN a critical area for observation and potential investment, especially within the current market cycle.

market trends and growth drivers for DePIN

The DePIN sector is experiencing rapid expansion, fueled by a confluence of technological advancements and increasing demand for decentralized solutions. Several key market trends are propelling this growth, making it a particularly attractive area for investment before the end of 2025. The convergence of IoT, AI, and blockchain technology is creating fertile ground for innovative DePIN applications across diverse industries.

One primary driver is the escalating need for more efficient and robust infrastructure. As global populations grow and digital dependency intensifies, existing centralized systems often struggle to keep pace. DePINs offer a scalable and cost-effective alternative, allowing for rapid deployment and expansion of networks with minimal overhead. Furthermore, the inherent transparency and immutability of blockchain technology enhance trust and security, which are paramount in critical infrastructure.

key growth factors

Several factors are contributing to the accelerated adoption and development of DePIN projects. Understanding these elements can help in identifying projects with strong growth potential.

- IoT Integration: The proliferation of Internet of Things (IoT) devices provides a vast network of physical assets that can be integrated into DePINs, from smart sensors to autonomous vehicles.

- Increased Demand for Data: The exponential growth of data generation requires more efficient and decentralized storage and processing solutions, areas where DePIN excels.

- Web3 Ecosystem Maturation: The broader Web3 ecosystem, including DeFi and NFTs, provides a robust foundation and liquidity for DePIN projects to thrive.

- Incentivized Participation: Tokenomics models effectively motivate individuals to contribute resources, fostering organic network expansion and maintenance.

The regulatory landscape, while still evolving, is also gradually becoming more accommodating to blockchain-based innovations. As governments and institutions begin to understand the benefits of decentralization, clearer guidelines and supportive policies could further accelerate DePIN adoption. This creates a more stable environment for both developers and investors.

Moreover, the increasing awareness of data privacy and security concerns is pushing users towards decentralized alternatives. DePINs, by distributing data storage and processing, offer a more secure and private environment compared to centralized cloud services. This focus on user sovereignty aligns perfectly with the ethos of Web3 and is a powerful motivator for broader adoption. The collective impact of these trends suggests a significant upward trajectory for DePIN projects in the coming years.

identifying promising DePIN projects for investment

Navigating the burgeoning DePIN landscape to identify truly promising projects requires a discerning eye and thorough research. Not all projects will succeed, and distinguishing between hype and genuine innovation is critical for maximizing returns. A strategic approach involves evaluating a project’s technological foundation, economic model, team expertise, and community engagement.

Start by examining the problem a DePIN project aims to solve. Does it address a real-world need with a viable decentralized solution? Projects that tackle significant pain points in existing centralized industries often have the strongest potential for widespread adoption and value accrual. Consider the size of the target market and the project’s competitive advantage.

due diligence essentials

Before committing to any investment, conduct comprehensive due diligence. This involves looking beyond marketing materials and delving into the fundamental aspects of the project.

- Technology and Innovation: Assess the underlying blockchain and network architecture. Is it genuinely decentralized? Is the technology robust and scalable?

- Tokenomics and Incentives: Analyze the token distribution model, utility, and inflation mechanisms. Does it create sustainable incentives for network participants?

- Team and Advisors: Research the experience and track record of the development team and their advisors. Strong leadership is paramount.

- Community and Partnerships: A vibrant and engaged community, coupled with strategic partnerships, indicates strong ecosystem support and potential for growth.

Furthermore, assess the project’s roadmap and milestones. A clear, achievable roadmap demonstrates thoughtful planning and a commitment to delivery. Look for projects that have already achieved significant technical milestones or established early traction in their respective markets. Early indicators of real-world utility, such as pilot programs or existing user bases, are strong positive signals.

It’s also prudent to consider the project’s compliance with regulatory standards. While the DePIN space is innovative, adherence to legal frameworks can significantly mitigate risks and foster long-term stability. Projects proactively addressing regulatory concerns are generally more resilient. By meticulously evaluating these factors, investors can increase their chances of identifying high-potential DePIN opportunities.

risks and challenges in DePIN investments

While the potential for significant returns in DePIN projects is undeniable, it is equally important to acknowledge and understand the inherent risks and challenges. Like any emerging technology sector, DePIN is subject to volatility, regulatory uncertainties, and technical hurdles. A balanced perspective is crucial for making informed investment decisions and managing expectations.

Market volatility is a constant factor in the cryptocurrency space, and DePIN tokens are no exception. Prices can fluctuate wildly based on market sentiment, news, and broader economic trends. Investors must be prepared for potential drawdowns and avoid making decisions based on short-term price movements. Patience and a long-term outlook are often rewarded in this nascent sector.

navigating potential pitfalls

Several specific challenges can impact the success and profitability of DePIN investments. Awareness of these issues allows for better risk mitigation strategies.

- Regulatory Uncertainty: The lack of clear regulatory frameworks in many jurisdictions can create legal ambiguities and potential operational challenges for DePIN projects.

- Technological Scalability: Ensuring that decentralized networks can scale to meet real-world demand without compromising performance or security is a significant technical hurdle.

- Adoption Barriers: Convincing mainstream users and businesses to adopt new decentralized infrastructure requires significant education, ease of use, and proven reliability.

- Competition: The DePIN space is becoming increasingly crowded, leading to intense competition for resources, users, and market share.

Security risks, such as smart contract vulnerabilities or network attacks, also pose a threat. While blockchain technology is inherently secure, implementation flaws can still lead to exploits. Investors should prioritize projects that have undergone rigorous security audits and have robust bug bounty programs. Furthermore, the reliance on token incentives means that the economic model must be carefully designed to prevent manipulation or unsustainable inflation.

The operational complexity of managing decentralized physical infrastructure can also be a challenge. Ensuring consistent uptime, maintenance, and quality of service across a distributed network requires sophisticated orchestration and effective community management. Projects with well-defined governance models and strong community engagement are better positioned to overcome these operational hurdles. Understanding these risks is not meant to deter investment but to encourage a more strategic and cautious approach.

strategies for maximizing returns in DePIN before 2025

To truly maximize returns from the emerging DePIN sector before the end of 2025, investors need to adopt a strategic and proactive approach. This involves not only identifying promising projects but also understanding optimal entry and exit points, diversifying portfolios, and actively participating in the ecosystem. The time-sensitive nature of this opportunity demands a well-thought-out plan.

One crucial strategy is to focus on early-stage projects with strong fundamentals and innovative solutions. Getting in before widespread adoption can lead to significantly higher returns as the project gains traction and its network effect grows. However, this also comes with increased risk, necessitating thorough due diligence and a high-risk tolerance.

effective investment approaches

Implementing specific strategies can help optimize your investment outcomes in the DePIN space.

- Early-Stage Investment: Identify projects in their seed or private sale rounds, if accessible, or soon after their public launch, but only after rigorous research.

- Portfolio Diversification: Spread investments across multiple DePIN projects in different sub-sectors (e.g., storage, wireless, energy) to mitigate specific project risks.

- Active Participation: Consider becoming a node operator or contributor to DePIN networks where feasible, earning additional tokens and supporting network growth.

- Long-Term Holding (HODLing): For projects with strong fundamentals, a long-term holding strategy can capitalize on sustained growth as the sector matures.

Another effective strategy involves monitoring market sentiment and technological advancements closely. Staying informed about new partnerships, technological breakthroughs, and regulatory developments can provide an edge in anticipating market movements. Following reputable analysts and engaging with project communities can offer valuable insights.

Furthermore, consider the potential for yield generation within DePIN ecosystems. Many projects offer staking rewards or opportunities to provide liquidity, allowing investors to earn passive income on their holdings. This can significantly boost overall returns, especially in a bullish market. However, be mindful of impermanent loss risks if providing liquidity to decentralized exchanges. By combining these strategies, investors can position themselves to capture the full potential of the DePIN boom.

the future landscape: DePIN beyond 2025

While the focus is on maximizing returns before 2025, it is equally important to consider the long-term trajectory and transformative potential of DePIN beyond this immediate window. The foundational changes being implemented today are setting the stage for a future where decentralized physical infrastructure is an integral part of our global economy. This long-term vision offers compelling reasons for sustained interest and investment.

Beyond 2025, DePIN is expected to mature, with more established projects, clearer regulatory frameworks, and broader mainstream adoption. The initial speculative phase will likely give way to a period of sustained growth driven by real-world utility and integration into traditional industries. We can anticipate DePIN becoming a standard component of smart cities, sustainable energy grids, and global connectivity solutions.

envisioning a decentralized future

The long-term impact of DePIN extends far beyond mere financial returns. It encompasses a fundamental reshaping of how societies manage and access essential services.

- Global Accessibility: DePIN can provide access to infrastructure in underserved regions, fostering economic development and bridging digital divides.

- Enhanced Resilience: Decentralized networks are inherently more resilient to outages, cyberattacks, and natural disasters compared to centralized systems.

- Economic Empowerment: Individuals and small businesses can participate in and profit from infrastructure ownership, democratizing wealth creation.

- Sustainability: DePIN can incentivize environmentally friendly practices, such as decentralized renewable energy grids and efficient resource management.

The integration of artificial intelligence (AI) with DePIN will also play a pivotal role. AI can optimize network performance, predict maintenance needs, and enhance the efficiency of resource allocation within decentralized physical infrastructure. This synergy will unlock new levels of autonomy and intelligence for these networks, further solidifying their value proposition.

Ultimately, DePIN represents a movement towards a more equitable, efficient, and resilient future. The investments made today are not just in tokens but in the foundational building blocks of a new digital and physical economy. The period before 2025 is a critical inflection point, but the true impact and sustained value of DePIN will unfold in the decades that follow, making it a compelling area for long-term engagement and innovation.

| Key Aspect | Brief Description |

|---|---|

| Time-Sensitive Opportunity | The period before late 2025 offers a unique window for early engagement with DePIN projects before broader market maturation. |

| DePIN Definition | Decentralized Physical Infrastructure Networks leverage blockchain to build and maintain real-world infrastructure via token incentives. |

| Growth Drivers | IoT integration, demand for data, Web3 ecosystem maturation, and incentivized participation are fueling DePIN growth. |

| Investment Strategy | Focus on early-stage projects, diversify portfolios, consider active participation, and adopt a long-term holding perspective. |

frequently asked questions about DePIN investments

The period before 2025 is considered time-sensitive because the DePIN sector is still in its early growth phase. Early adoption and investment can yield higher returns before mainstream maturation and increased competition potentially stabilize prices and reduce explosive growth potential.

DePIN projects generate value through the utility and adoption of their native tokens. As the underlying physical infrastructure network grows and provides more services, demand for its tokens increases, driving up their value. Investors can also earn rewards by contributing to the network.

Key risks include market volatility, regulatory uncertainty, technological scalability challenges, and intense competition. Additionally, the success of DePIN projects relies heavily on real-world adoption, which can be slow, and potential security vulnerabilities in smart contracts.

Look for projects with a clear problem statement, innovative technology, robust tokenomics, an experienced team, and strong community engagement. Evaluate their roadmap, partnerships, and early signs of real-world utility or adoption to gauge potential success and sustainability.

Yes, DePIN projects are expected to have long-term relevance. Beyond 2025, the sector is likely to mature with broader adoption, clearer regulations, and deeper integration into various industries, leading to sustainable growth and the creation of essential decentralized services globally.

conclusion

The current landscape presents a compelling, time-sensitive opportunity to engage with emerging DePIN projects before the close of 2025. By understanding the core principles of decentralized physical infrastructure, analyzing market trends, and diligently assessing investment opportunities while acknowledging inherent risks, investors can strategically position themselves for potentially significant returns. The transformative potential of DePIN extends far beyond immediate financial gains, promising a more resilient, equitable, and efficient future for global infrastructure. Early and informed participation in this innovative sector can yield substantial benefits as Web3 continues to reshape our digital and physical worlds.