Smart Contract Security: 3 Critical Areas for 2025

Smart contract security vulnerabilities represent a significant threat to Web3, necessitating urgent attention to three critical areas before January 2025 to safeguard decentralized applications and user assets effectively.

As the Web3 ecosystem continues its rapid expansion, the integrity and security of smart contracts become paramount. Understanding and mitigating smart contract security vulnerabilities is no longer optional; it’s a critical imperative for anyone involved in decentralized finance, NFTs, or any blockchain-based application. With January 2025 on the horizon, a proactive stance against emerging threats is essential.

The Evolving Threat Landscape for Smart Contracts

The digital frontier of blockchain technology, while revolutionary, is also a fertile ground for sophisticated cyber threats. Smart contracts, the self-executing agreements at the heart of Web3, are particularly attractive targets for malicious actors due to their immutable nature and direct control over valuable assets. This section delves into the dynamic nature of these threats and why vigilance is key.

The complexity of smart contract code, often written in languages like Solidity, can inadvertently introduce bugs or logical flaws that adversaries can exploit. These vulnerabilities are not static; they evolve with new attack vectors and increasingly sophisticated methods, making continuous education and adaptation crucial for developers and project owners alike. The financial stakes involved are often immense, turning every vulnerability into a potential multi-million dollar disaster.

Understanding the Attacker’s Mindset

To effectively defend against smart contract exploits, one must first comprehend the motivations and techniques of attackers. They are often driven by financial gain, seeking to drain funds from vulnerable contracts, manipulate market prices, or disrupt services. Their methods range from exploiting known flaws to discovering zero-day vulnerabilities through rigorous analysis and even social engineering.

- Financial Gain: The primary motivator for most smart contract attacks, targeting large pools of cryptocurrency.

- System Disruption: Attacks aimed at destabilizing decentralized applications or entire blockchain networks.

- Reputational Damage: Malicious acts intended to undermine public trust in specific projects or the Web3 ecosystem as a whole.

The relentless pursuit of vulnerabilities by sophisticated attackers means that even seemingly minor oversights in contract design or implementation can lead to catastrophic consequences. This necessitates a robust and multi-layered security strategy that goes beyond basic auditing.

In conclusion, the threat landscape for smart contracts is a constantly shifting battleground. Staying ahead requires not only technical expertise but also a deep understanding of attacker psychology and the economic incentives that drive these exploits. Proactive measures and continuous security enhancements are indispensable.

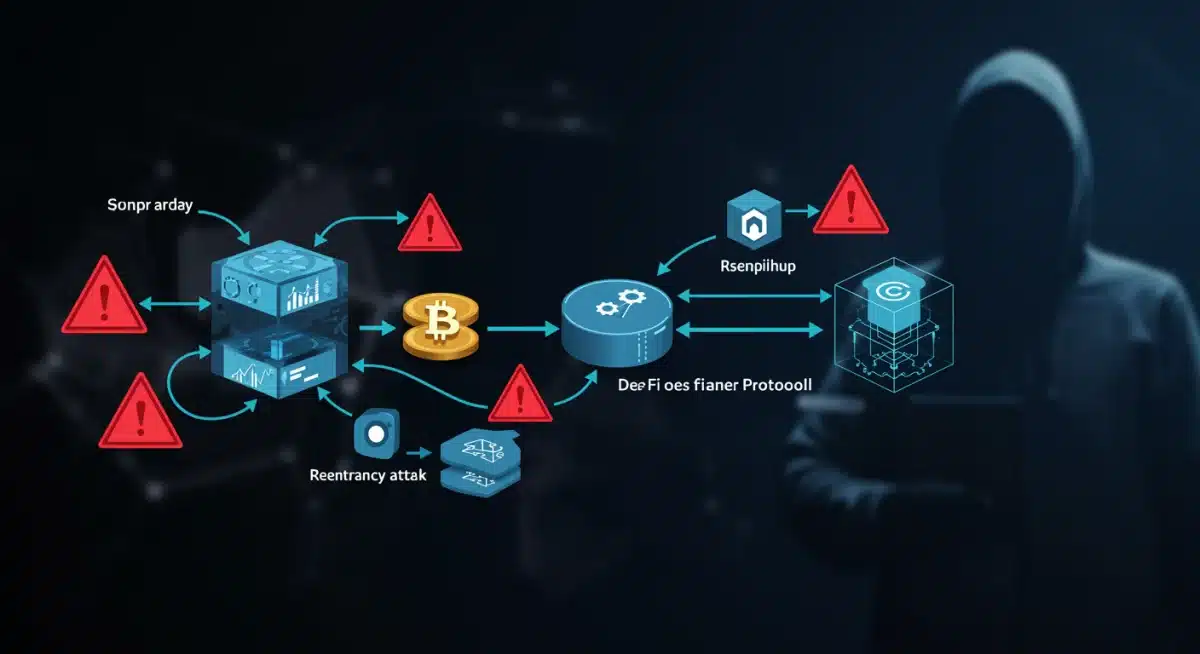

Reentrancy Attacks: A Persistent and Dangerous Flaw

Reentrancy attacks remain one of the most infamous and devastating types of smart contract vulnerabilities. Despite being well-documented since the DAO hack in 2016, new variations and implementations continue to emerge, proving that this flaw is far from eradicated. Understanding its mechanics and implementing preventative measures is critical.

A reentrancy attack occurs when an external call to another contract or address allows the external contract to call back into the original contract before the original contract has finished its execution. This can lead to a loop where funds are repeatedly withdrawn, or state variables are manipulated, before the contract’s state is properly updated. The consequences can be severe, leading to the draining of all funds from a vulnerable contract.

Prevention against reentrancy primarily involves careful coding practices and architectural design. The ‘checks-effects-interactions’ pattern is a fundamental principle that mandates updating the contract’s state (effects) before making external calls (interactions). This ensures that even if an external call attempts to re-enter, the state has already been modified, preventing further unauthorized actions.

Implementing Robust Reentrancy Guards

Beyond the fundamental pattern, several concrete strategies can significantly bolster a contract’s resilience against reentrancy. These involve a combination of language features, established libraries, and rigorous testing protocols.

- Use of Mutex Locks: Implementing a lock mechanism that prevents re-entry until the current execution path completes. Libraries like OpenZeppelin’s ReentrancyGuard provide ready-to-use solutions.

- Minimal External Calls: Reducing the number of external calls and ensuring they are made only to trusted, audited contracts. Each external call introduces a potential point of failure.

- Gas Limits and Stubs: While less common in modern Solidity due to changes in gas forwarding, older contracts might still benefit from careful consideration of gas limits on external calls to prevent complex re-entry logic.

Thorough testing, including unit tests, integration tests, and formal verification, is indispensable to confirm that reentrancy vulnerabilities are not present. Simulating various attack scenarios can help uncover subtle flaws that might otherwise go unnoticed.

In summary, while reentrancy is a known vulnerability, its persistence underscores the need for continuous education and the consistent application of best practices. Developers must prioritize secure coding patterns and leverage available tools to safeguard against this insidious attack vector.

Oracle Manipulation: The Achilles’ Heel of DeFi

Oracle manipulation attacks exploit the reliance of smart contracts on external data feeds, known as oracles. In decentralized finance (DeFi), where protocols often depend on real-world asset prices, exchange rates, or other off-chain information, a compromised oracle can lead to massive financial losses and systemic instability. Before January 2025, robust oracle solutions are non-negotiable.

Attackers can manipulate oracle feeds by various means, such as flash loan attacks where they temporarily inflate or deflate the price of a token on a decentralized exchange (DEX) that the oracle queries. If the smart contract then uses this manipulated price to execute a trade, issue a loan, or liquidate collateral, the attacker can profit significantly at the expense of the protocol and its users.

Securing Oracle Integrations

The key to preventing oracle manipulation lies in diversifying data sources, decentralizing oracle networks, and implementing robust validation mechanisms. A single point of failure in an oracle feed is an open invitation for exploitation.

- Decentralized Oracles: Utilizing decentralized oracle networks like Chainlink or Band Protocol, which aggregate data from multiple independent sources, making manipulation significantly harder.

- Time-Weighted Average Prices (TWAPs): Instead of relying on instant price feeds, using TWAPs can mitigate the impact of short-term price fluctuations or flash loan attacks by averaging prices over a period.

- Multiple Oracle Sources: Integrating data from several different oracle providers and cross-referencing their feeds to identify discrepancies or malicious inputs.

Furthermore, protocols should implement circuit breakers or emergency shutdown mechanisms that can pause operations if oracle data appears to be anomalous or manipulated. This allows time for investigation and mitigation before irreversible damage occurs.

The reliance on external data makes oracle security a complex challenge, but one that is absolutely critical for the stability and trustworthiness of DeFi. Protocols must invest in resilient oracle solutions and implement comprehensive monitoring to detect and respond to potential manipulation attempts swiftly.

Access Control Vulnerabilities: Unauthorized Entry Points

Access control vulnerabilities arise when smart contracts fail to properly restrict who can execute certain sensitive functions. This can lead to unauthorized users gaining administrative privileges, draining funds, or altering critical contract parameters. As we approach January 2025, tightening access control is paramount to preventing insider threats and external exploits.

Common mistakes include hardcoding administrator addresses, using insecure authentication mechanisms, or failing to implement multi-signature requirements for critical operations. An attacker who gains control over an administrator’s private key, or exploits a flaw in a single-point-of-control contract, can effectively take over the entire protocol, leading to devastating consequences.

Implementing Granular and Secure Access Mechanisms

Effective access control requires a thoughtful design that balances security with operational efficiency. It’s about ensuring that only authorized entities can perform specific actions, and that these authorizations are robust and tamper-proof.

- Role-Based Access Control (RBAC): Assigning specific roles (e.g., administrator, user, owner) with predefined permissions, ensuring that functions are only callable by the roles intended.

- Multi-Signature Wallets (Multi-sig): Requiring multiple parties to approve critical transactions, significantly reducing the risk of a single point of compromise. This is crucial for treasury management and contract upgrades.

- Timelock Contracts: Introducing a delay between the proposal of a critical action (like an upgrade or parameter change) and its actual execution. This gives the community or other guardians time to react if a malicious proposal is made.

Regular audits and security reviews should specifically focus on access control mechanisms, probing for potential bypasses or unintended permissions. Formal verification can also be employed to mathematically prove the correctness of access control logic.

Ultimately, robust access control is a foundational pillar of smart contract security. By carefully designing and implementing granular permission structures, projects can significantly reduce the attack surface and protect against unauthorized actions.

Front-Running and MEV Exploits: The Invisible Threat

Front-running and Miner Extractable Value (MEV) exploits represent a more subtle yet pervasive class of vulnerabilities that can significantly impact user experience and fairness in decentralized applications. These attacks capitalize on the transparency of blockchain transactions in the mempool, allowing malicious actors to observe, reorder, or censor transactions for their own gain. With the increasing sophistication of MEV bots, addressing these issues before 2025 is vital.

Front-running occurs when an attacker sees a pending transaction (e.g., a large swap on a DEX) and submits their own transaction with a higher gas fee to execute it before the original transaction. This allows them to profit from the price change caused by the original transaction. MEV encompasses a broader range of strategies where miners (or validators in PoS) can extract value by arbitrarily including, excluding, or reordering transactions within a block.

Mitigating Front-Running and MEV

While completely eliminating MEV might be challenging due to the fundamental nature of public blockchains, several strategies can help mitigate its impact and protect users from front-running attacks. This requires a combination of protocol design and user-side awareness.

- Commit-Reveal Schemes: For certain types of transactions (e.g., auctions or private bids), users can first commit a hash of their action and then reveal the actual action in a subsequent transaction, preventing front-running.

- Batching Transactions: Grouping multiple transactions into a single batch can make it harder for front-runners to isolate and exploit individual transactions.

- Decentralized Sequencers/Private Transaction Relays: Using services that allow users to submit transactions directly to validators without exposing them to the public mempool, thus reducing the opportunity for front-running.

Developers should also design their smart contracts to be less susceptible to price manipulation and timing attacks, for example, by using TWAPs for price feeds as mentioned earlier. Educating users about the risks and providing tools for privacy-preserving transactions are also important steps.

In conclusion, front-running and MEV are complex challenges that require ongoing research and innovative solutions. By implementing thoughtful contract design and leveraging emerging technologies, the Web3 community can work towards creating a more equitable and secure transaction environment.

The Importance of Continuous Auditing and Formal Verification

In the high-stakes environment of smart contracts, a single audit is rarely enough. The dynamic nature of blockchain development, coupled with the constant emergence of new attack vectors, necessitates a regime of continuous auditing and, where appropriate, formal verification. This proactive approach is essential to maintaining the security posture of smart contracts well into 2025 and beyond.

Traditional security audits involve expert teams manually reviewing code, identifying vulnerabilities, and suggesting remediations. While invaluable, these are snapshots in time. As contracts evolve, new features are added, or integrations change, new vulnerabilities can be inadvertently introduced. This is where continuous auditing, often augmented by automated tools, becomes critical.

Integrating Advanced Security Methodologies

Moving beyond basic audits, incorporating more advanced security methodologies into the development lifecycle is key. This includes leveraging sophisticated tools and techniques that offer a higher degree of assurance.

- Automated Static Analysis: Tools that scan contract code for known vulnerability patterns, coding errors, and adherence to best practices, providing immediate feedback during development.

- Bug Bounty Programs: Incentivizing white-hat hackers to find and report vulnerabilities before malicious actors do. This leverages the collective intelligence of the security community.

- Formal Verification: A rigorous mathematical process of proving that a smart contract behaves exactly as intended under all possible conditions, eliminating entire classes of bugs and logical flaws. While resource-intensive, it’s ideal for critical components.

Furthermore, post-deployment monitoring and incident response plans are crucial. Real-time monitoring can detect unusual activity or potential exploits, allowing teams to react quickly and minimize damage. A well-defined incident response plan can guide teams through crisis situations, from vulnerability confirmation to remediation and communication.

In conclusion, smart contract security is an ongoing journey, not a destination. By embracing continuous auditing, automated analysis, bug bounties, and formal verification, projects can significantly enhance their resilience against attacks and build greater trust within the Web3 ecosystem.

| Key Security Area | Brief Description of Threat/Solution |

|---|---|

| Reentrancy Attacks | Exploiting external calls to repeatedly drain funds before state updates. Mitigate with ‘checks-effects-interactions’ pattern and mutex locks. |

| Oracle Manipulation | Compromising external data feeds to manipulate asset prices. Prevent with decentralized oracles and Time-Weighted Average Prices (TWAPs). |

| Access Control Flaws | Unauthorized execution of sensitive functions due to poor permissions. Implement Role-Based Access Control and multi-signature wallets. |

| Front-Running & MEV | Exploiting transaction visibility in mempool for profit. Mitigate with commit-reveal schemes and private transaction relays. |

Frequently Asked Questions About Smart Contract Security

A smart contract security vulnerability refers to a flaw or weakness in the code or logic of a smart contract that can be exploited by malicious actors. These exploits can lead to unauthorized access, fund loss, or manipulation of the contract’s intended behavior, posing significant risks to decentralized applications.

Despite being a long-standing vulnerability, reentrancy attacks persist because developers sometimes overlook the ‘checks-effects-interactions’ pattern or introduce new variations in complex contract interactions. Continuous vigilance, robust testing, and the use of reentrancy guards are essential to prevent these exploits in modern smart contracts.

Preventing oracle manipulation involves using decentralized oracle networks that aggregate data from multiple sources, implementing Time-Weighted Average Prices (TWAPs) instead of spot prices, and integrating multiple oracle providers for cross-verification. These strategies reduce reliance on single data points and enhance data integrity.

Continuous auditing is crucial because smart contracts evolve, and new vulnerabilities can emerge with updates or integrations. It involves regular security reviews, automated static analysis, and bug bounty programs to proactively identify and address flaws throughout the contract’s lifecycle, ensuring ongoing protection against new threats.

Formal verification provides a mathematical proof that a smart contract behaves exactly as specified under all conditions, eliminating entire classes of bugs and logical errors. For critical contracts handling significant value or complex operations, it offers the highest level of assurance, complementing traditional auditing methods.

Conclusion

The landscape of smart contract security is dynamic and challenging, demanding constant vigilance and adaptation. Addressing the critical vulnerabilities discussed—reentrancy attacks, oracle manipulation, and access control flaws—before January 2025 is not merely a recommendation but an absolute necessity for safeguarding the integrity and trust within the Web3 ecosystem. By embracing rigorous development practices, continuous auditing, and innovative security solutions, developers and project teams can build more resilient decentralized applications, ensuring a safer and more sustainable future for blockchain technology.