DeFi: New Liquid Staking Protocols Explored

The recent surge in decentralized finance (DeFi) innovation has introduced several novel approaches to liquid staking, offering users increased capital efficiency while participating in network security.

The decentralized finance (DeFi) landscape is in a constant state of evolution, pushing the boundaries of what’s possible within blockchain ecosystems. Among the most exciting recent developments are the emergence of new liquid staking protocols, which promise to revolutionize how users engage with proof-of-stake networks. These innovative platforms offer a compelling solution to the traditional illiquidity of staked assets, allowing participants to earn staking rewards while retaining access to their capital for other DeFi opportunities.

Understanding Liquid Staking in the DeFi Landscape

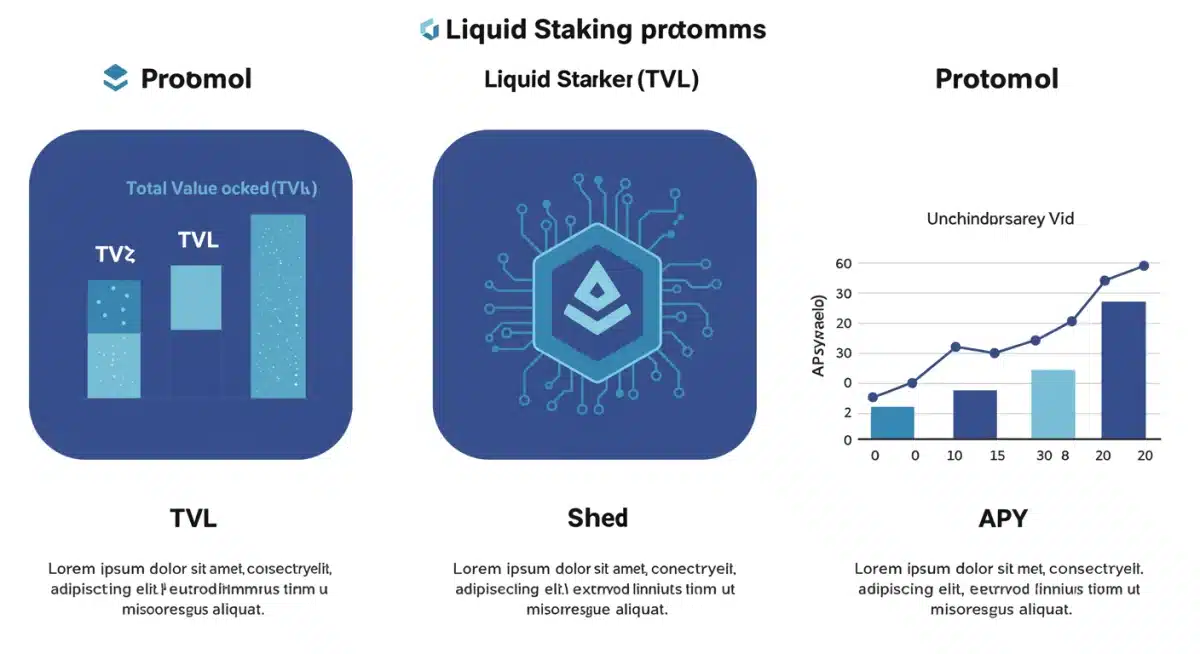

Liquid staking has emerged as a cornerstone of modern DeFi, addressing a fundamental challenge in proof-of-stake (PoS) networks: the trade-off between securing the network and maintaining asset liquidity. When users stake their cryptocurrencies to validate transactions and earn rewards, their assets are typically locked for a period, making them inaccessible for other uses. Liquid staking protocols resolve this by issuing a liquid token representing the staked asset, which can then be used across the broader DeFi ecosystem.

This innovative mechanism unlocks significant capital efficiency. Stakers can earn native staking rewards while simultaneously utilizing their liquid staking derivatives (LSDs) in various DeFi applications, such as lending, borrowing, or providing liquidity to decentralized exchanges. The demand for such solutions has grown exponentially as more blockchains adopt PoS, making liquid staking a critical component for maximizing yield and utility in a decentralized environment.

The Mechanics of Liquid Staking

At its core, liquid staking involves a user depositing their PoS tokens into a smart contract managed by a liquid staking protocol. In return, the protocol mints an equivalent amount of a liquid staking derivative token. This derivative token is typically pegged 1:1 to the underlying staked asset and accrues staking rewards over time, either by increasing in value relative to the underlying asset or by being rebated directly to the holder.

- Delegation: Protocols aggregate user deposits and delegate them to a network of professional validators.

- Reward Distribution: Staking rewards earned by validators are passed back to the liquid staking token holders, often after deducting a small fee for the protocol’s operation.

- Redemption: Users can typically redeem their liquid staking tokens for the underlying staked assets, though this process might involve an unbonding period depending on the underlying blockchain.

The ability to use these LSDs across DeFi is a game-changer. It allows for composability, where different DeFi protocols can be stacked on top of each other to create complex financial strategies. This not only enhances potential returns but also diversifies risk by spreading capital across multiple applications. The growth of liquid staking is a testament to DeFi’s continuous innovation, striving to create a more efficient and accessible financial system.

Protocol Alpha: Pioneering a New Era of Capital Efficiency

Protocol Alpha, launched just two months ago, has rapidly garnered attention for its novel approach to liquid staking on the Ethereum network. It distinguishes itself by focusing on extreme capital efficiency and integrating deeply with emerging Layer 2 solutions. The protocol aims to provide stakers with unparalleled flexibility, allowing them to participate in securing Ethereum while simultaneously leveraging their staked assets in high-yield DeFi strategies across various scaling solutions.

The team behind Protocol Alpha emphasizes security and decentralization, employing a multi-audited smart contract architecture and a decentralized validator set. Their commitment to these principles has instilled confidence among early adopters, contributing to a swift accumulation of Total Value Locked (TVL). The protocol’s design also incorporates a governance model that empowers token holders, ensuring community-driven development and decision-making.

Key Innovations of Protocol Alpha

Protocol Alpha introduces several features designed to optimize the liquid staking experience. One notable innovation is its dynamic yield optimization algorithm, which automatically rebalances staked assets across validators to maximize returns. This proactive management minimizes the need for users to constantly monitor and adjust their staking positions, making it an attractive option for both novice and experienced stakers.

- Cross-Chain Compatibility: Alpha’s liquid staking token (aETH) is designed for seamless integration across multiple EVM-compatible chains and Layer 2s, expanding its utility far beyond the primary network.

- Enhanced Security Measures: Beyond standard audits, Protocol Alpha implements a bug bounty program and formal verification methods to bolster its smart contract security against potential vulnerabilities.

- Staking Pool Diversity: The protocol allows users to choose from a diverse set of independent validators, promoting network decentralization and reducing single points of failure.

The user experience is paramount for Protocol Alpha. They have developed an intuitive interface that simplifies the staking and unstaking processes, along with clear dashboards for tracking rewards and asset performance. This focus on accessibility, combined with robust technical underpinnings, positions Protocol Alpha as a significant contender in the evolving liquid staking landscape, promising to set new standards for user-centric DeFi solutions.

BetaStake: Bridging Traditional Finance and DeFi Staking

BetaStake, launched last month, is carving out a unique niche by targeting institutional investors and traditional finance (TradFi) entities looking to enter the liquid staking space. While many protocols focus purely on retail users, BetaStake’s design incorporates compliance features and robust risk management frameworks that appeal to larger, more regulated players. This strategic focus aims to bridge the gap between traditional financial markets and the burgeoning DeFi ecosystem, bringing significant liquidity and institutional credibility to liquid staking.

The protocol operates on a distinct proof-of-stake blockchain, offering high throughput and low transaction costs, which are crucial for institutional-grade operations. BetaStake’s commitment to regulatory adherence is evident in its Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures, which are integrated into its platform for specific institutional offerings. This dual approach allows for both permissioned and permissionless access, catering to a broad spectrum of users while maintaining a compliant environment for those who require it.

Institutional-Grade Features of BetaStake

BetaStake’s architecture is built with enterprise-level requirements in mind. It provides dedicated API access for institutional clients, enabling seamless integration with existing financial systems. The protocol also offers advanced reporting and analytics tools, crucial for compliance and portfolio management in a regulated environment. Their liquid staking token (bSTAKE) is designed to be highly interoperable, facilitating its use across various institutional DeFi platforms.

- Dedicated Institutional Onboarding: A streamlined process tailored for institutions, including legal and compliance support.

- Customizable Staking Strategies: Institutions can choose from a range of staking strategies, including options for different risk profiles and reward preferences.

- Robust Oracle Integration: BetaStake leverages multiple decentralized oracle networks to ensure the integrity and reliability of its pricing data and reward calculations.

The vision for BetaStake extends beyond just staking; it aims to become a foundational layer for institutional DeFi. By providing a secure, compliant, and efficient liquid staking solution, BetaStake is poised to unlock vast amounts of capital from traditional finance, accelerating the mainstream adoption of decentralized technologies. Its unique positioning addresses a critical need in the market, making it a pivotal player in the future evolution of DeFi.

GammaFlex: Optimized Yields Through Dynamic Strategy Aggregation

GammaFlex, a protocol that launched just three weeks ago, is making waves with its innovative approach to liquid staking through dynamic strategy aggregation. Unlike protocols that offer a single liquid staking token, GammaFlex allows users to deposit their assets into various yield-generating strategies, including liquid staking, farming, and lending, all managed through a single interface. This flexibility empowers users to optimize their returns based on current market conditions and their risk tolerance, positioning GammaFlex as a versatile hub for diversified DeFi yield generation.

The core strength of GammaFlex lies in its intelligent contract architecture, which constantly monitors and rebalances assets across the most profitable and secure strategies. This automated optimization minimizes user effort while maximizing potential returns. The protocol’s commitment to transparency is evident in its detailed performance dashboards and open-source code, allowing users to verify the integrity and effectiveness of its underlying algorithms.

GammaFlex’s Adaptive Yield Strategies

GammaFlex distinguishes itself by offering a suite of adaptive yield strategies. Users can choose between conservative, balanced, or aggressive approaches, each with a different allocation across various DeFi protocols. The protocol’s AI-driven engine identifies and integrates new, audited yield opportunities as they emerge, ensuring that users always have access to the most competitive rates. This continuous adaptation is a significant advantage in the fast-paced DeFi environment.

- Multi-Asset Support: GammaFlex supports a wide range of cryptocurrencies for liquid staking and yield generation, providing users with more options than single-asset protocols.

- Automated Rebalancing: The protocol automatically shifts assets between strategies to maintain optimal risk-reward profiles and capture the highest available yields.

- Community Governance: Token holders have a say in the integration of new strategies and the overall direction of the protocol, fostering a strong, engaged community.

GammaFlex is designed for users who seek both passive income and active control over their DeFi investments. Its ability to dynamically adapt to market changes, combined with a user-friendly interface, makes it an attractive platform for maximizing returns from liquid staking and other DeFi activities. The protocol’s rapid growth since its launch underscores the market’s appetite for sophisticated yet accessible yield optimization tools.

Comparing the New Protocols: Alpha, Beta, and Gamma

When examining Protocol Alpha, BetaStake, and GammaFlex, distinct philosophies and target audiences emerge, shaping their features and potential impact on the DeFi ecosystem. While all three offer solutions for liquid staking, their approaches to capital efficiency, security, and market integration vary significantly. Understanding these differences is crucial for users looking to choose the most suitable platform for their specific needs and investment goals.

Protocol Alpha prioritizes broad accessibility and deep integration with Layer 2 solutions, aiming for maximum capital efficiency for the general DeFi user. Its focus is on making liquid staking as flexible and composable as possible within the Ethereum ecosystem. BetaStake, on the other hand, targets the institutional market, building a compliant and secure environment for large-scale capital deployment. GammaFlex takes a different route, offering dynamic yield aggregation and automated strategy management, appealing to users who want optimized returns across multiple DeFi avenues.

Key Differentiators and Use Cases

The unique selling propositions of each protocol cater to different segments of the DeFi market. Alpha’s strength lies in its permissionless nature and focus on composability within the broader Ethereum L2 landscape, making it ideal for retail users seeking diversified DeFi opportunities with their staked ETH.

BetaStake’s compliance-first approach and institutional-grade features make it the go-to choice for regulated entities and traditional financial institutions looking to gain exposure to staking rewards without navigating the complexities of raw DeFi. Its emphasis on security and regulatory adherence is a key differentiator.

- Protocol Alpha: Best for retail users seeking high composability and cross-chain functionality on Ethereum and L2s.

- BetaStake: Ideal for institutional investors prioritizing compliance, security, and integration with traditional financial systems.

- GammaFlex: Suited for yield-seeking users who prefer automated, dynamically optimized strategies across various DeFi protocols.

GammaFlex’s ability to aggregate and manage diverse yield strategies positions it as a ‘set-and-forget’ solution for users who want to maximize returns from liquid staking and other DeFi opportunities without constant manual intervention. Each protocol brings a valuable, distinct offering to the table, collectively expanding the utility and accessibility of liquid staking within the rapidly evolving DeFi space.

The Future Impact of New Liquid Staking Protocols on DeFi

The emergence of these new liquid staking protocols—Alpha, BetaStake, and GammaFlex—signifies a pivotal moment for the decentralized finance industry. Their diverse approaches to solving the liquidity challenge in proof-of-stake networks are not just incremental improvements; they represent a fundamental shift in how users can interact with and benefit from blockchain technology. The ripple effects of these innovations are expected to be profound, influencing everything from capital allocation to network security and the overall maturity of DeFi.

One of the most significant impacts will be the further unlocking of staked capital. As more efficient and secure liquid staking solutions become available, a larger portion of staked assets will become programmable, fueling liquidity across various DeFi applications. This increased capital efficiency will likely drive down costs, enhance yield opportunities, and create a more robust and interconnected financial ecosystem. The competition among these new protocols will also spur further innovation, pushing the boundaries of what liquid staking can offer.

Driving Adoption and Innovation

These protocols are not only catering to existing DeFi users but also attracting new participants, particularly institutional investors who were previously deterred by regulatory uncertainties and operational complexities. BetaStake’s focus on institutional-grade compliance is a prime example of how liquid staking is expanding its reach beyond the crypto-native audience, bringing in fresh liquidity and a new level of professionalism to the space.

- Enhanced Composability: Liquid staking tokens will become even more integral to DeFi, serving as collateral, liquidity, and yield-generating assets in a myriad of protocols.

- Improved Network Security: By making staking more attractive and accessible, these protocols encourage broader participation in network validation, thereby enhancing the security and decentralization of PoS blockchains.

- New Financial Primitives: The innovation in liquid staking is paving the way for entirely new financial products and services within DeFi, built upon the foundation of liquid staked assets.

The ongoing evolution of liquid staking is a clear indicator of DeFi’s dynamic nature. As these protocols mature and integrate more deeply with the broader Web3 ecosystem, they will undoubtedly play a critical role in shaping the future of decentralized finance, making it more efficient, accessible, and resilient for users worldwide.

| Key Protocol | Primary Focus |

|---|---|

| Protocol Alpha | Capital efficiency & L2 integration for retail users. |

| BetaStake | Institutional-grade compliance & security for TradFi. |

| GammaFlex | Dynamic strategy aggregation & optimized yield for diverse assets. |

| Overall Impact | Increased liquidity, broader adoption, and new financial primitives in DeFi. |

Frequently Asked Questions About Liquid Staking Protocols

Liquid staking allows users to stake their cryptocurrencies to earn network rewards while receiving a liquid token representing their staked assets. This token can then be used in other DeFi applications, solving the illiquidity issue of traditional staking and enhancing capital efficiency.

New protocols like Alpha, BetaStake, and GammaFlex introduce advanced features such as deeper Layer 2 integration, institutional-grade compliance, and dynamic yield aggregation, offering more specialized solutions and catering to a broader range of users than earlier iterations.

Risks include smart contract vulnerabilities, de-pegging of the liquid staking token from its underlying asset, and potential slashing penalties if validators perform maliciously. Users should always research protocols thoroughly and understand the inherent risks.

Yes, protocols like BetaStake are specifically designed for institutional investors, incorporating KYC/AML compliance and robust security frameworks to meet regulatory requirements and provide a secure entry point into decentralized finance for larger entities.

While some liquid staking protocols can concentrate power among a few validators, many new ones are actively working to diversify their validator sets and implement decentralized governance models to ensure broad participation and strengthen network decentralization.

Conclusion

The rapid proliferation and sophisticated design of new liquid staking protocols over the last three months underscore the relentless innovation within the DeFi space. Protocols like Alpha, BetaStake, and GammaFlex are not merely offering incremental improvements; they are fundamentally reshaping how users interact with proof-of-stake networks. By providing solutions that cater to diverse needs—from retail users seeking capital efficiency to institutions demanding compliance and optimized yields—these platforms are significantly advancing the utility and accessibility of decentralized finance. Their continued evolution promises to unlock greater liquidity, foster broader adoption, and ultimately contribute to a more robust, efficient, and interconnected Web3 ecosystem.