Institutional Investment & Altcoin Valuations: 2025 Outlook for US Investors

Institutional investment is poised to profoundly influence altcoin valuations by 2025, creating a dynamic landscape that US retail investors must understand to effectively navigate the cryptocurrency market’s future.

The cryptocurrency market, once dominated by individual enthusiasts, is rapidly maturing with the increasing involvement of significant institutional players. This shift is particularly impactful for altcoins, as their valuations become more intertwined with traditional finance. Understanding institutional altcoin investment is no longer just for experts; it’s crucial for US retail investors looking to position themselves strategically in 2025 and beyond.

The Shifting Landscape of Crypto Investment

The cryptocurrency market, historically characterized by its volatility and retail-driven nature, is undergoing a profound transformation. What was once a niche interest has now attracted the attention of major financial institutions, including hedge funds, asset managers, and even traditional banks. This influx of institutional capital is not merely a trend; it’s a fundamental reshaping of market dynamics, particularly for altcoins.

For US retail investors, this means navigating a market that is increasingly influenced by factors beyond individual sentiment or technological hype. Institutional investment brings with it a different set of motivations, risk assessments, and investment horizons, which can lead to both greater stability and potentially larger, more sustained price movements. Understanding these underlying forces is paramount to making informed decisions in the evolving digital asset space.

Institutional Entry Points and Mechanisms

Institutions don’t typically buy altcoins directly on unregulated exchanges. Their entry points are often more structured and compliant with existing financial regulations. This includes:

- Grayscale-like Trusts: Products that allow accredited investors to gain exposure to various altcoins without directly holding them.

- Exchange-Traded Funds (ETFs): While Bitcoin ETFs have paved the way, altcoin-specific ETFs are emerging, offering regulated access.

- Venture Capital Funding: Direct investment into promising blockchain projects and protocols, often before their tokens are widely available.

- Over-the-Counter (OTC) Desks: Private transactions for large volumes, minimizing market impact.

These mechanisms provide a bridge between traditional finance and the decentralized world, offering institutions the compliance and liquidity they require. The existence and expansion of these avenues are direct indicators of growing institutional confidence and appetite for altcoins.

The growing sophistication of these investment vehicles suggests a long-term commitment from institutions rather than short-term speculative plays. This sustained interest can provide a more robust foundation for altcoin valuations, differentiating them from the speculative bubbles of past cycles. Retail investors should observe which altcoins gain institutional backing through these channels, as it often signals a higher degree of due diligence and potential for future growth.

Drivers of Institutional Interest in Altcoins

Why are institutions suddenly so keen on altcoins? The reasons are multifaceted, extending beyond mere speculation to fundamental shifts in technology and finance. Understanding these drivers helps US retail investors anticipate which altcoins might attract the most institutional capital.

One primary driver is the pursuit of diversification. As Bitcoin matures and its correlation with traditional assets sometimes increases, institutions look to altcoins for uncorrelated returns and higher growth potential. They seek projects with strong fundamentals, innovative technology, and clear use cases that can disrupt existing industries or create entirely new ones.

Technological Innovation and Real-World Utility

Institutions are increasingly recognizing the transformative potential of specific blockchain technologies beyond Bitcoin. This includes:

- Decentralized Finance (DeFi): Protocols offering lending, borrowing, and trading without intermediaries.

- Non-Fungible Tokens (NFTs): Digital ownership for art, gaming, and real-world assets.

- Layer 2 Solutions: Projects enhancing scalability and efficiency for major blockchains like Ethereum.

- Enterprise Blockchain: Solutions for supply chain management, data integrity, and cross-border payments.

Projects that demonstrate clear, tangible utility and solve real-world problems are particularly attractive. Institutions conduct rigorous due diligence, focusing on the team, technology, tokenomics, and regulatory compliance of a project. This discerning approach means that not all altcoins will benefit equally from institutional interest; those with robust ecosystems and proven utility are likely to be favored.

Furthermore, the evolving regulatory landscape plays a significant role. As jurisdictions like the US begin to provide clearer guidelines for digital assets, institutions gain greater confidence to enter the market. Regulatory clarity reduces uncertainty and mitigates compliance risks, making altcoin investments more palatable for large-scale financial entities. This regulatory maturation is a critical catalyst for increased institutional flows.

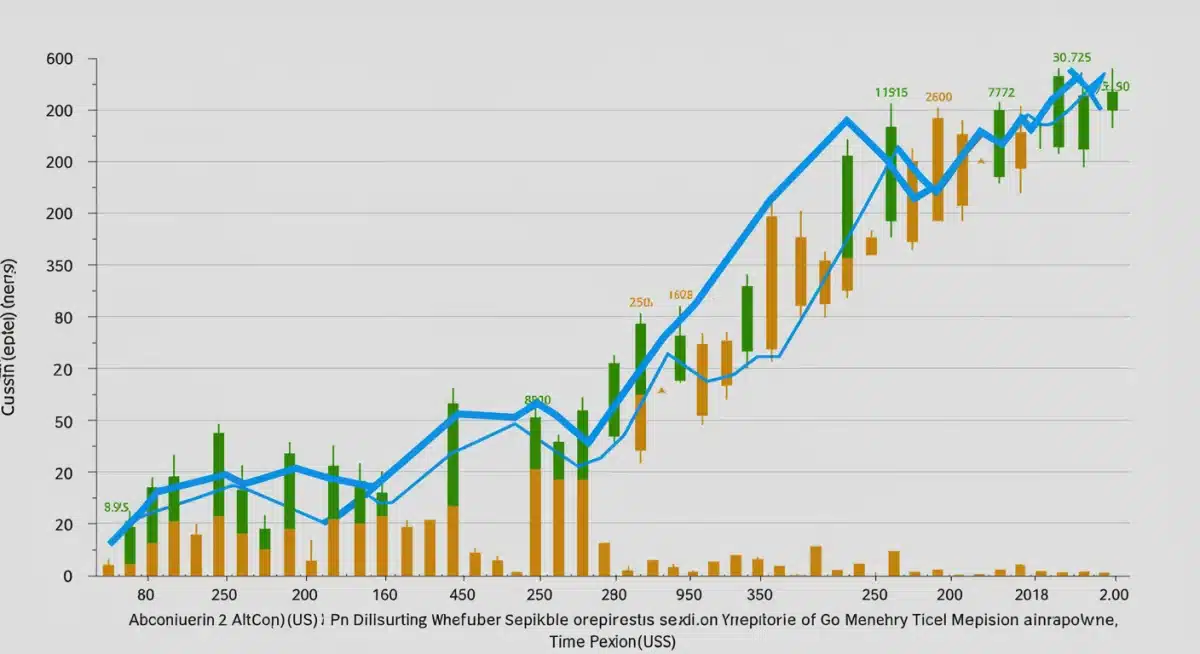

Impact on Altcoin Valuations: A 2025 Outlook

The influx of institutional capital directly influences altcoin valuations through several mechanisms, creating a distinct outlook for 2025. This impact is not uniform across all altcoins but tends to concentrate on projects that meet institutional criteria for liquidity, security, and growth potential.

Firstly, significant capital injections can lead to increased demand and, consequently, higher prices for favored altcoins. Unlike retail investors, institutions often deploy substantial sums, moving markets with their entry and exit strategies. This can create more stable price floors and reduce extreme volatility in the short term, though price discovery remains a dynamic process.

Increased Liquidity and Market Maturity

One of the most immediate effects of institutional involvement is enhanced market liquidity. Larger trading volumes and deeper order books make it easier for both institutions and retail investors to enter and exit positions without significantly impacting prices. This increased liquidity is a hallmark of a maturing market.

- Reduced Price Volatility: Greater liquidity can smooth out drastic price swings, making altcoins more appealing to risk-averse investors.

- Professionalization of Trading: Institutions bring advanced trading strategies, arbitrage opportunities, and market-making activities.

- Improved Price Discovery: More efficient markets where prices more accurately reflect underlying value.

The professionalization stemming from institutional engagement also fosters a more sophisticated ecosystem. This includes better data analytics, enhanced custodial services, and more robust compliance frameworks, all of which contribute to the overall maturity and credibility of the altcoin market.

Secondly, institutional backing often lends credibility to altcoin projects, attracting further retail and institutional interest. When a reputable institution invests in an altcoin, it signals a level of validation that can influence other investors. This can create a virtuous cycle of investment, driving valuations higher as confidence grows. By 2025, we can expect a clearer distinction between institutionally-favored altcoins and those that remain primarily retail-driven.

Challenges and Risks for Retail Investors

While institutional investment can bring stability and growth, it also introduces new challenges and risks for US retail investors. The dynamics of a market increasingly shaped by large players are fundamentally different from those of a purely retail-driven ecosystem. Understanding these potential pitfalls is crucial for protecting investments and capitalizing on opportunities.

One significant risk is the potential for increased market manipulation or front-running. Institutions, with their superior resources and information access, might execute trades that move the market before retail investors can react. This information asymmetry can put individual investors at a disadvantage, making it harder to predict price movements based solely on public sentiment or technical analysis.

Navigating Institutional Influence

Retail investors must adapt their strategies to account for institutional behavior. This involves:

- Avoiding FOMO (Fear Of Missing Out): Institutional entries can create rapid price surges, but retail investors should avoid impulse buying at peak prices.

- Focusing on Long-Term Fundamentals: Instead of chasing short-term pumps, identify altcoins with strong technology, clear use cases, and solid teams that align with institutional investment theses.

- Understanding Liquidation Events: Large institutional sell-offs can trigger significant price drops, requiring retail investors to have clear exit strategies.

The increased sophistication of the market also means that retail investors need to conduct even more thorough due diligence. Relying on social media trends or anecdotal evidence becomes riskier when up against professional analysis and high-frequency trading algorithms. Education and a disciplined investment approach are more critical than ever.

Another challenge is the potential for regulatory changes that disproportionately affect retail investors. While regulatory clarity generally benefits institutions, specific regulations could impose restrictions on retail access or increase compliance burdens. Staying informed about the evolving regulatory landscape in the US is vital for all investors in the altcoin space.

Key Altcoin Sectors Attracting Institutional Capital

Not all altcoins are created equal in the eyes of institutional investors. Certain sectors within the altcoin ecosystem are more attractive due to their potential for scalability, innovation, and alignment with traditional financial models. Identifying these key sectors can help US retail investors narrow down their research and identify promising opportunities for 2025.

Decentralized Finance (DeFi) continues to be a magnet for institutional capital. The promise of disintermediating traditional financial services – from lending and borrowing to insurance and asset management – resonates strongly with institutions looking for efficiency and new revenue streams. Projects that offer robust security, audited smart contracts, and high liquidity pools are particularly favored.

Emerging Trends and Niche Markets

- Interoperability Solutions: Protocols that enable different blockchains to communicate and transfer assets seamlessly, addressing a critical need for a more connected crypto ecosystem.

- Decentralized Storage Networks: Projects offering secure, distributed data storage solutions that rival or surpass centralized cloud providers.

- Gaming and Metaverse Platforms: While still nascent, the potential for digital economies and virtual worlds is attracting venture capital and institutional interest in projects building foundational infrastructure.

- Privacy-Focused Altcoins: As regulatory scrutiny increases, privacy solutions might see renewed interest from institutions seeking to offer compliant yet secure transactions.

The narrative around environmental sustainability is also influencing institutional choices. Projects that demonstrate energy efficiency or are actively working towards reducing their carbon footprint are likely to be preferred, aligning with broader ESG (Environmental, Social, and Governance) mandates in traditional finance.

Institutions are also keenly observing the development of real-world asset (RWA) tokenization. The ability to represent tangible assets like real estate, commodities, or even intellectual property on a blockchain opens up vast new markets for liquidity and fractional ownership. Altcoins that facilitate secure and compliant RWA tokenization could see significant institutional inflows by 2025, fundamentally altering how traditional assets are traded and managed.

Strategic Considerations for US Retail Investors in 2025

For US retail investors looking at altcoins in 2025, adapting to a market increasingly shaped by institutional investment requires a strategic and informed approach. The passive investment strategies of the past may no longer suffice in this evolving landscape. Proactive research, risk management, and a clear understanding of market dynamics are paramount.

Firstly, it’s crucial to differentiate between altcoins that align with institutional investment theses and those that remain purely speculative. Institutional interest often signals a deeper level of due diligence, technological soundness, and potential for long-term growth. Retail investors can leverage this by researching altcoins that have already attracted significant institutional backing or exhibit characteristics that would appeal to such investors.

Building a Resilient Altcoin Portfolio

To navigate the 2025 altcoin market effectively, consider these strategies:

- Diversification: Spread investments across various altcoin sectors and market capitalizations to mitigate risk.

- Due Diligence: Conduct thorough research on a project’s technology, team, tokenomics, community, and regulatory compliance.

- Risk Management: Only invest what you can afford to lose, and consider setting stop-loss orders to limit potential downsides.

- Stay Informed: Keep abreast of regulatory developments, technological advancements, and institutional sentiment towards different altcoin categories.

Understanding the macroeconomic environment is also more critical than ever. Factors such as interest rates, inflation, and global economic stability can influence institutional risk appetite, which in turn affects altcoin valuations. A holistic view that integrates both crypto-specific and traditional financial analysis will be increasingly valuable.

Finally, consider the role of custodial solutions and secure storage. As altcoin holdings grow, especially for long-term investments, the security of your digital assets becomes paramount. Utilizing reputable hardware wallets or trusted custodial services can protect against hacks and loss, a lesson often learned the hard way in the crypto space. The institutionalization of crypto also means a greater emphasis on secure and compliant asset management practices, which retail investors should also adopt.

| Key Point | Brief Description |

|---|---|

| Institutional Influx | Significant capital from hedge funds and asset managers is reshaping altcoin market dynamics. |

| Valuation Impact | Increased demand, liquidity, and credibility leading to more stable, higher valuations for favored altcoins. |

| Retail Investor Challenges | New risks include market manipulation and information asymmetry, requiring adaptive strategies. |

| Key Altcoin Sectors | DeFi, interoperability, decentralized storage, and RWA tokenization are attracting strong institutional interest. |

Frequently Asked Questions About Institutional Altcoin Investment

Institutional investment significantly boosts altcoin liquidity by increasing trading volumes and order book depth. This makes it easier for both large and small investors to buy and sell altcoins without causing drastic price fluctuations, leading to a more stable market environment.

Sectors like Decentralized Finance (DeFi), interoperability solutions, decentralized storage, and real-world asset (RWA) tokenization are highly attractive. Institutions prioritize projects with strong fundamentals, clear utility, and potential for significant market disruption or efficiency gains.

Retail investors face risks such as information asymmetry, potential market manipulation, and the impact of large institutional sell-offs. It’s crucial for retail investors to conduct thorough research, practice strong risk management, and avoid impulsive trading based on institutional moves.

Generally, increased institutional investment is expected to reduce extreme altcoin volatility by providing deeper liquidity and more mature trading practices. However, large institutional entries or exits can still cause significant price swings, so volatility will likely remain a factor, albeit potentially less erratic.

Retail investors can look for news of major venture capital rounds, investments in Grayscale-like trusts, or the launch of altcoin-specific ETFs. These often indicate that an altcoin project has undergone significant institutional due diligence and has secured substantial financial backing.

Conclusion

The landscape of altcoin investment is undeniably evolving, with institutional capital acting as a powerful catalyst for change. For US retail investors, 2025 promises a market that is more mature, liquid, and potentially less volatile, yet also one where understanding the motivations and strategies of large institutional players is paramount. By focusing on fundamental analysis, diversifying portfolios across promising sectors like DeFi and RWA tokenization, and maintaining a disciplined approach to risk management, retail investors can navigate this new era successfully. The integration of traditional finance with the crypto world presents both unprecedented opportunities and new challenges, making informed decision-making more critical than ever.