Cross-Chain Smart Contracts 2026: New U.S. Business Models

By 2026, cross-chain smart contracts are projected to unlock three transformative business models for U.S. enterprises, driving unprecedented efficiency, interoperability, and market expansion through recent technological advancements and strategic implementations.

The digital economy is constantly evolving, and by 2026, cross-chain smart contracts are poised to redefine how U.S. enterprises conduct business. This technology promises to break down the silos between diverse blockchain networks, fostering unprecedented interoperability and unlocking novel opportunities for innovation and growth. Understanding these shifts is crucial for any forward-thinking organization.

the evolution of cross-chain smart contracts

The journey of smart contracts has been remarkable, from their initial conceptualization to their current sophisticated implementations. Initially, smart contracts operated within the confines of a single blockchain, limiting their reach and potential. The demand for broader functionality led to the development of cross-chain solutions.

Early attempts at cross-chain communication were often complex and prone to security vulnerabilities. However, significant advancements in cryptographic techniques and protocol design have matured the landscape. We are now seeing robust frameworks emerge that enable secure and efficient interaction across disparate blockchain ecosystems, laying the groundwork for widespread enterprise adoption. U.S. enterprises are now evaluating these mature solutions for practical applications.

key technological enablers

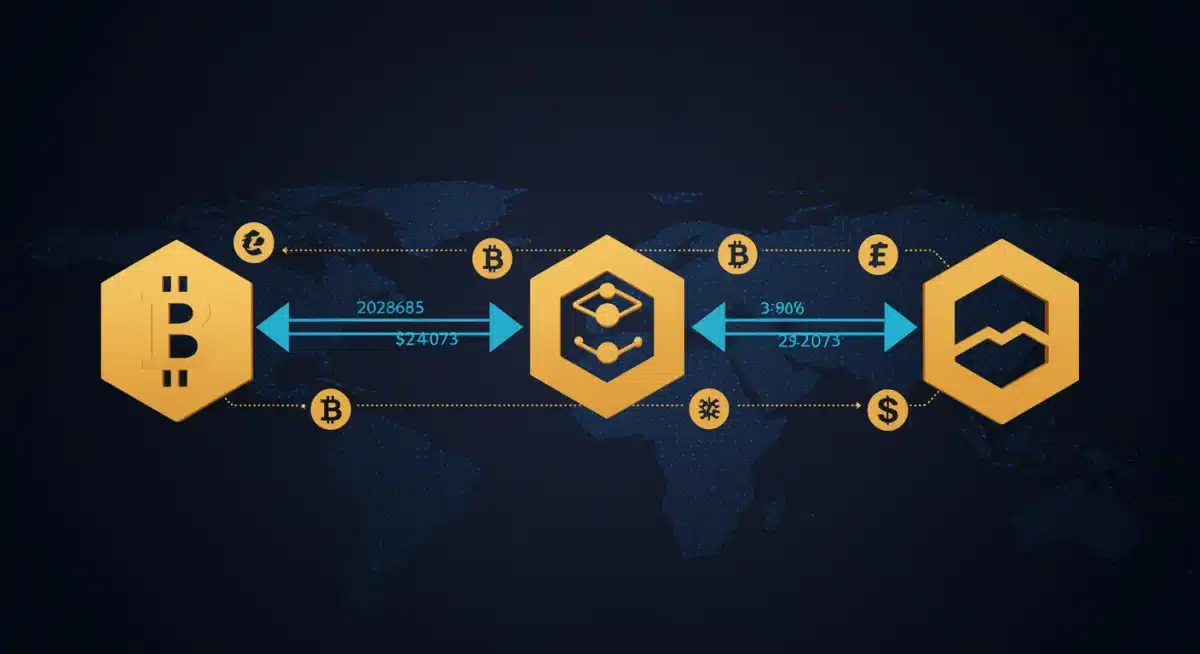

- Atomic Swaps: These allow for the exchange of cryptocurrencies from different blockchains without needing a trusted third party.

- Relay Chains and Parachains: Architectures like Polkadot and Cosmos facilitate communication and shared security among connected chains.

- Oracles: External data feeds that connect real-world information to blockchain networks, crucial for cross-chain contract execution.

- Layer 2 Solutions: Technologies that enhance scalability and reduce transaction costs, often facilitating cross-chain interactions more efficiently.

The evolution underscores a clear trend: the blockchain world is moving towards a highly interconnected future. This interconnectedness is not merely a technical upgrade; it’s a fundamental shift that will enable business models previously deemed impossible due to technological fragmentation.

new business model 1: decentralized supply chain optimization

One of the most immediate and impactful applications of cross-chain smart contracts for U.S. enterprises is in revolutionizing supply chain management. Traditional supply chains are often characterized by opacity, inefficiency, and a lack of real-time data sharing across different participants and systems. Cross-chain smart contracts offer a potent solution to these long-standing challenges.

Imagine a supply chain where each stage, from raw material sourcing to final product delivery, is recorded and verified across multiple, potentially distinct, blockchain networks. A manufacturer might use one blockchain for inventory management, while a logistics partner uses another for tracking shipments, and a financial institution uses a third for payment processing. Cross-chain smart contracts enable these disparate systems to communicate and execute agreements seamlessly.

enhanced transparency and traceability

With cross-chain capabilities, enterprises can achieve unprecedented levels of transparency. Every transaction, every movement of goods, and every change in ownership can be immutably recorded and accessible to authorized parties across different chains. This not only builds trust among participants but also significantly reduces disputes and fraud.

- Real-time Tracking: Monitor goods across diverse logistics providers, regardless of their underlying blockchain infrastructure.

- Automated Compliance: Smart contracts can automatically verify adherence to regulatory standards and contractual obligations.

- Fraud Prevention: Immutable records across chains make it extremely difficult to falsify data related to product origin or quality.

The ability to trace products from origin to consumer across various blockchain platforms eliminates information silos. This holistic view empowers businesses to identify bottlenecks, optimize routes, and respond proactively to disruptions, ultimately leading to more resilient and efficient supply chains. The potential for cost savings and improved customer satisfaction is immense.

new business model 2: fractionalized asset ownership and liquidity

The concept of fractionalized asset ownership, powered by cross-chain smart contracts, opens up entirely new avenues for U.S. enterprises, particularly in sectors dealing with high-value or illiquid assets. This model allows for the division of ownership of an asset into smaller, tradable digital tokens, which can then be managed and exchanged across different blockchain networks.

Consider real estate, fine art, or intellectual property. Traditionally, these assets require significant capital investment and are difficult to transfer. By tokenizing these assets and enabling their fractional ownership via cross-chain smart contracts, enterprises can democratize access, increase liquidity, and create new investment opportunities. This is not just about digitizing existing assets; it’s about making them more accessible and tradable on a global scale.

democratizing investment and increasing market access

Fractionalization significantly lowers the barrier to entry for investors, allowing them to own a portion of an asset rather than the entire entity. This expands the pool of potential investors and can lead to more efficient price discovery. Cross-chain capabilities further enhance this by allowing these fractionalized tokens to be traded on various decentralized exchanges operating on different blockchains.

- Real Estate Tokenization: Investing in a fraction of a commercial property, accessible to a broader range of investors.

- Art and Collectibles: Shared ownership of high-value art pieces, enabling greater liquidity and investment appeal.

- Intellectual Property Rights: Licensing and royalty distribution through fractionalized tokens across multiple platforms.

This model facilitates greater capital formation and enables enterprises to unlock value from assets that were previously difficult to monetize. The enhanced liquidity provided by cross-chain trading mechanisms ensures that investors can enter and exit positions more easily, making these fractionalized assets more attractive. This will undoubtedly reshape investment landscapes and asset management strategies.

new business model 3: interoperable decentralized finance (defi) services

The burgeoning decentralized finance (DeFi) sector presents a fertile ground for cross-chain smart contracts to create innovative business models for U.S. enterprises. While DeFi has seen explosive growth, its current fragmented nature across different blockchains limits its full potential. Cross-chain smart contracts are the key to unlocking true interoperability within DeFi, leading to more robust and versatile financial services.

Enterprises can leverage cross-chain capabilities to offer a new generation of financial products that are not confined to a single blockchain. This could include cross-chain lending platforms, synthetic assets that mirror the value of assets on other chains, or decentralized exchanges that facilitate seamless trading between tokens from different ecosystems. The goal is to create a unified, borderless financial system.

expanding financial product offerings

The ability to interact with assets and protocols across multiple blockchains allows enterprises to build more sophisticated and capital-efficient DeFi services. For example, a U.S. enterprise could offer a lending service where users deposit collateral on one blockchain (e.g., Ethereum) and borrow funds on another (e.g., Solana), all orchestrated by a cross-chain smart contract.

- Cross-Chain Lending/Borrowing: Utilize collateral from one chain to borrow on another, optimizing capital.

- Synthetic Assets: Create tokens on one chain that represent assets from another, enabling broader market exposure.

- Interoperable DEXs: Facilitate atomic swaps and liquidity provision across different blockchain networks.

This paradigm shift enables enterprises to tap into a wider range of liquidity pools and offer more competitive rates and innovative financial instruments. The increased flexibility and efficiency will attract both institutional and retail investors, driving significant growth in the DeFi sector and creating powerful new revenue streams for U.S. businesses. The potential for financial innovation is limitless.

recent updates and insider knowledge

The rapid pace of development in the cross-chain smart contract space means that staying informed about the latest updates and insider knowledge is paramount for U.S. enterprises. Several key trends and technological breakthroughs are shaping the landscape, indicating where the market is heading and what opportunities might arise.

One significant area of focus is the enhancement of security protocols for cross-chain bridges. Early bridge designs were sometimes vulnerable, leading to high-profile exploits. However, significant investment in auditing, formal verification, and multi-party computation (MPC) solutions has dramatically improved the security posture of newer cross-chain infrastructure. This increased security builds confidence for enterprise adoption.

emerging standards and collaborations

The industry is also seeing a push towards standardization and greater collaboration among different blockchain projects and foundations. Initiatives like the Inter-Blockchain Communication (IBC) protocol, initially for Cosmos, are being explored for broader application, allowing for more seamless and secure data exchange. These collaborative efforts are crucial for building a cohesive cross-chain ecosystem.

- Zero-Knowledge Proofs (ZKPs): Increasingly used to enhance privacy and scalability in cross-chain transactions.

- Account Abstraction: Simplifying user experience by allowing smart contracts to manage accounts, improving cross-chain interaction.

- Institutional Adoption Frameworks: Development of compliant and regulated pathways for enterprises to engage with cross-chain DeFi.

Insider knowledge suggests a strong focus on pragmatic, scalable solutions that address real-world enterprise needs. This includes developing user-friendly interfaces and robust developer tools that lower the barrier to entry for businesses looking to integrate cross-chain capabilities. The emphasis is on making these complex technologies accessible and beneficial for mainstream enterprises.

challenges and considerations for u.s. enterprises

While the promise of cross-chain smart contracts is immense, U.S. enterprises must navigate several challenges to fully leverage this technology. Understanding these considerations is crucial for strategic planning and successful implementation, ensuring that the benefits outweigh the potential risks.

One of the primary concerns revolves around regulatory clarity. The decentralized nature of blockchain and cross-chain interactions often falls into a legal gray area, particularly in the United States where regulatory frameworks are still evolving. Enterprises must carefully assess compliance requirements and engage with legal experts to ensure their cross-chain initiatives adhere to existing and emerging regulations.

security and interoperability risks

Despite advancements, security remains a paramount concern. Cross-chain bridges and protocols, by their very nature, introduce new attack vectors. Enterprises must conduct thorough due diligence on the security architecture of any cross-chain solution they consider. Furthermore, true interoperability is still a work in progress, with varying levels of integration and compatibility across different chains.

- Smart Contract Audits: Essential for identifying and mitigating vulnerabilities before deployment.

- Oracles’ Reliability: Ensuring the integrity and trustworthiness of external data feeds is critical for contract execution.

- Scalability Issues: While improving, some cross-chain solutions still face challenges in handling high transaction volumes efficiently.

Another significant consideration is the technical complexity involved. Integrating cross-chain solutions often requires specialized expertise and a significant investment in infrastructure and talent. Enterprises need to weigh the costs and benefits carefully and consider partnering with experienced blockchain development firms or technology providers. Addressing these challenges head-on will be key to unlocking the full potential of cross-chain smart contracts by 2026.

| Key Point | Brief Description |

|---|---|

| Supply Chain Optimization | Cross-chain smart contracts enhance transparency, traceability, and efficiency across complex supply networks. |

| Fractionalized Asset Ownership | Enables tokenization and shared ownership of high-value assets, increasing liquidity and market access. |

| Interoperable DeFi Services | Expands financial product offerings by connecting diverse DeFi protocols across different blockchains. |

| Challenges & Considerations | Regulatory uncertainty, security risks, and technical complexity require careful navigation for adoption. |

frequently asked questions about cross-chain smart contracts

Cross-chain smart contracts are automated agreements that can execute and interact across different independent blockchain networks. This interoperability allows data, assets, and logic to flow seamlessly between previously isolated blockchain ecosystems, enabling more complex and versatile applications than single-chain contracts.

By 2026, U.S. enterprises can leverage cross-chain smart contracts to unlock new business models such as decentralized supply chain optimization, fractionalized asset ownership for increased liquidity, and interoperable DeFi services, leading to greater efficiency, market reach, and innovative financial products.

Security concerns mainly revolve around the robustness of cross-chain bridges and protocols. Vulnerabilities in these mechanisms can lead to asset loss. Enterprises must prioritize solutions with strong cryptographic security, regular audits, and advanced techniques like multi-party computation (MPC) to mitigate risks effectively.

Yes, integration with traditional enterprise resource planning (ERP) and legacy systems is a key focus. Oracles play a vital role by feeding real-world data into blockchain networks, while API gateways are being developed to facilitate seamless data exchange between on-chain and off-chain environments, enabling hybrid solutions.

U.S. businesses face evolving regulatory landscapes concerning digital assets and decentralized technologies. Clarity is needed on how existing laws apply to cross-chain transactions, tokenized assets, and DeFi services. Engaging with legal counsel and staying updated on regulatory developments from bodies like the SEC and CFTC is crucial.

conclusion

The advent of cross-chain smart contracts represents a pivotal moment for U.S. enterprises, promising to dismantle existing technological barriers and usher in an era of unprecedented connectivity and innovation. By 2026, the strategic adoption of these technologies will not merely optimize current operations but will fundamentally reshape business landscapes through decentralized supply chain management, fractionalized asset ownership, and interoperable DeFi services. While challenges related to security and regulation persist, the rapid advancements and collaborative efforts within the blockchain ecosystem are paving the way for robust, scalable, and secure cross-chain solutions. Enterprises that proactively embrace and integrate these capabilities will be best positioned to thrive in the interconnected digital economy of the future.